Struggling to turn NOs into a YES? Feeling unprepared at handling the variety of objections buyers toss your way? Read this article to learn about the four categories all buyer objections fall into and how to tackle them!

Ironically, online real estate buyer leads can be incredibly creative in coming up with reasons NOT to buy a home! As the famous saying goes, "buyers are liars". The very best real estate agents can turn almost any NO from a buyer into a YES. So how do they do it? And more importantly, what can you do to turn more NOs into YESs?

We spent this month interviewing 24 of our best performing real estate teams to learn about how they overcome common buyer objections. We condensed our learnings into this article to help agents and teams everywhere apply the same principles to overcome buyer objections and convert more leads!

First, put your doctor hat on

Let’s start with an analogy here to make things easy to put into perspective: convincing a buyer to buy now instead of later is like a doctor curing a sick patient. I know it’s a bit of a leap here, but stay with me, I promise it’ll make sense in a moment!

The first step to curing a sick patient is figuring out what illness he or she is afflicted by. Rarely does a patient walk in and say “Hi doctor, I have Type A Influenza, and I need a treatment plan right away“, that would be pretty unlikely right?

Instead, patients walk in with one or more symptoms of their illness that they describe to the doctor like: “Hi doctor, I’ve had a fever and stuffy nose the last few days”. The doctor’s job is to use a strategic line of questioning on the patient to figure out exactly what illness the patient might be suffering from.

Once the illness has been identified, the doctor can proceed to prescribe the proper medication and treatment plan to help the patient get back to good health again.

Okay, so now that you’ve indulged in my analogy, how the heck does it relate to handling buyer objections? Read on and I promise to answer that question!

Develop a line of questioning

When a potential buyer lead tells you “Hey Mr./Ms. Agent, I submitted an inquiry, but ignore it because it’s not the right time for me to buy right now” the untrained agent will likely proceed to end the conversation after trading pleasantries. However, that statement is very much like a sick patient stepping into a doctor’s office and saying “I’ve got a fever”. It is important to recognize that an objection is the beginning of a conversation and not the end.

So how do you revive the conversation and recapture the lead’s interest? By strategically using a line of questioning! Similar to a doctor asking a sick patient to share more information about her illness, your goal is to ask your buyer lead WHY she feels it isn’t the right time to buy right now.

The insight that an objection is the beginning of a conversation and NOT the end is extremely crucial to acknowledge if you’re going to make significant progress turning NOs into YESs. Okay so now what’s next? The four categories!

The Four Categories of Buyer Objections

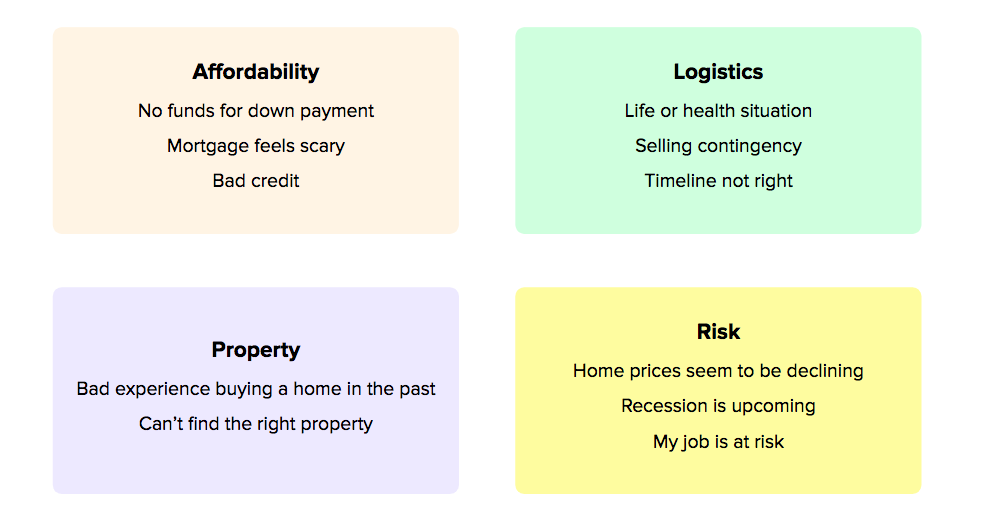

The second step to overcoming buyer objections is to recognize that there are really only four categories that all objections fall into: Affordability, Logistics, Property, and Risk.

Affordability. The most common reason buyers don’t move forward is because they are concerned about their ability to afford a home. They might feel their credit isn’t good enough, stressed by making mortgage payments, or haven’t saved up enough for a down payment.

Logistics. This is the second most common category and covers a range of objections that prevent buyers from moving forward due to logistical reasons like life situations, health issues, or the need to sell their home first.

Property. The third most common category of objections involves the inability of the buyer to find the right property that fits their needs. Maybe a past buying experience has colored their opinion or they are struggling to find the perfect home.

Risk. This category covers the buyer’s perceived financial risk of buying due to macroeconomic conditions or stability of their financial situation.

By learning to quickly bucket objections into one of these four categories, you should be able to sway more buyers into buying now instead of later. So now let’s break down each one and look at how you can build some defensive maneuvers!

Handling Affordability Objections

The most common category of objections falls into a buyer’s perceived inability to financially afford a home. Few common objections you might hear include:

- I have bad credit right now, can’t really buy

- Paying down a mortgage feels scary

- Haven’t saved up funds for a down payment

- Can’t afford to buy right now, don’t make enough money

The best way to handle affordability objections is to open the eyes of the buyer to financial possibilities that they might not have considered that can help them afford a home. For example:

- Educate the buyer on low-to-no down payment loan programs

- Offer to introduce them to a lender that can help repair their credit

- Show them the tax advantages of a mortgage vs. renting

- Share with them the financial advantages of owning a home

- Put together a spreadsheet showing them the net cost of owning vs. renting. Additionally, you can send them a title cost calculator to give them a clear picture of the final transaction.

However, as we learned earlier, it is important to convey this information in a line of questioning format rather than presenting them as facts. If a buyer feels that paying down a mortgage is scary, here’s an example line of questioning you can use to educate and engage creatively:

You: What about the mortgage payment feels scary to you?

Lead: I don’t know, but we’re paying $1,200 in rent right now, a mortgage on a $200,000 home can be pretty heavy, not sure if I can afford it right now

You: If we can help you keep your mortgage payments at the same level or lower than those of your rent, would that change your decision?

Lead: Hmm maybe, how would that work?

You: Okay cool, so there are tax benefits related to mortgage payments you can take advantage of and also other benefits of home ownership. If you have a couple minutes to meet up or chat on the phone this week, I can put together a spreadsheet showing you how we can help accomplish that. Would that work?

Handling Logistics Objections

A home is likely the largest financial purchase someone might make in their lifetime. Most buyers don’t just decide to buy on a whim (at least we hope!). Buyers spend time thinking and fantasizing about what it’ll be like to live in the home, how the home will be decorated, what their commute will look like among a dozen other logistical items.

Common logistical objections you might encounter include:

- I’m getting married, probably best to wait to buy

- We’re expecting a new baby, probably best to wait to buy

- We need to sell our home first before we buy

- The timing isn’t right for me right now to buy a home

More often than not, logistics objections are really about affordability, specifically, the timing of finances that affect your buyer’s ability to buy right now. The best way to handle logistics objections is to use a line of questioning to figure out exactly why the lead feels it’s not the right time to buy right now. For example:

You: Congrats on being engaged! Are you looking to settle down at your current place with your partner?

Lead: Most likely yes

You: Gotcha! Is the main reason you don’t want to buy right now because you guys aren’t sure where you will settle down?

Lead: No it’s really about the upcoming wedding expenses, not sure if we can really afford to put a down payment on a home

You: Ah gotcha! [treat this as an affordability objection]

By using a line of questioning to figure out exactly what the issue preventing the buyer from moving forward is, you can quickly diagnose the problem and work on a solution!

Handling Property Objections

Property objections are less common, but come up once in a while. This category of objections usually relate to a buyer who doesn’t feel confident about his or her ability to find the right property that’ll make them happy.

Sometimes buyers are too specific with their criteria or sometimes they aren’t specific enough, in either case, there’s a real situation where a buyer struggles to find the right property and gives up on the search altogether.

Your goal here is to show the buyer hope, make him or her feel it is possible to find the right home and be happy!

Maybe they found the right home, but just in the wrong neighborhood, or the wrong home in the right neighborhood, maybe they need to evaluate whether they really need five bedrooms and three baths.

IF you believe their problem can be easily solved by just exploring more inventory, then great! Let them know that you have listings in mind that you can show them.

IF they can find their dream home by remodeling an existing one, then introduce them to some contractors who can share more information about the process and costs.

IF your buyer needs to recalibrate their search and reset their expectations, don’t be afraid to tell them that, they’ll appreciate it in the long run!

Handling Risk Objections

The last category of objections is all about a buyer’s perceived risk of buying a property. Risk-related objections usually take one of two forms: macro and micro risk.

Macro risk is related to the economy or real estate markets. For example, declining home prices or talks of a recession can convince a potential buyer to defer their decision to buy until the skies clear up.

Micro risk is related to the risk of a buyer’s personal financial stability. Things like an upcoming layoff at their employer or changes in job prospects in their field or industry can really shake a buyer’s financial confidence.

The goal in either case is to either highlight the risk of waiting (less inventory, prices may go up, rates may go up) or discount the risk altogether (home prices are cyclical so they come back up, home equity helps you borrow in difficult times).

Much like a doctor’s, a real estate agent’s job is to handle the objections (problem) with a line of questioning (symptoms) to come up with a solution (treatment plan) and convince buyers that it is better to buy now than later. With this approach and the recognition that all objections fall into one of four categories, you can easily convert more NOs into YESs!

Aiva

Aiva